Gratuity Calculation in West Bengal – Formula, Rules & Guide

Gratuity Calculation in West Bengal is one of the most important post-employment benefits for salaried workers across India. If you work in West Bengal or manage staff there, understanding how gratuity is computed, when it is payable, and what West Bengal–specific procedures and timelines apply will help you avoid costly mistakes. This guide explains the legal framework, the standard calculation formula, illustrative worked examples, West Bengal rules and forms, ceiling and tax information, employer duties, and practical steps for both employees and employers.

What gratuity means and the legal framework

Gratuity is a monetary benefit paid by an employer to an employee for long and meritorious service. At the central level the Payment of Gratuity Act, 1972 provides the statutory framework that governs Gratuity Calculation in West Bengal across India; this Act defines who is eligible, the rate of gratuity, dispute resolution and recovery mechanisms, and empowers the Central Government to specify limits and rules. India Code

West Bengal enforces the central Act and has its own implementing rules — the West Bengal Payment of Gratuity Rules, 1973 — which set out administrative procedures (application timelines, forms, registers, and controlling authorities) that employers and employees in the state must follow. These state rules supplement the central Act and are the reference point when you are dealing with a West Bengal establishment. wblc.gov.inkarmamgmt.com

Who is covered and minimum eligibility Gratuity Calculation in West Bengal

Under the Act and West Bengal rules, Gratuity Calculation in West Bengal is payable to employees in establishments covered by the Act. Key coverage notes:

- The Act generally applies to factories, mines, oilfields, plantations, ports, railway companies, shops and establishments employing 10 or more workers (state rules and notifications set thresholds). Chief Labour Commissioner

- An employee must complete a minimum of five years of continuous service with the employer to be eligible for statutory gratuity, except in cases of death or permanent disablement where the five-year requirement does not apply. Chief Labour Commissionerwb.gov.in

The West Bengal rules also explain that “[continuous service]” calculations, payment application windows, and the handling of disputes are to be performed in accordance with the state’s implementing procedures. Employers should maintain a gratuity register and relevant records as required by the rules. wblc.gov.inwb.gov.in

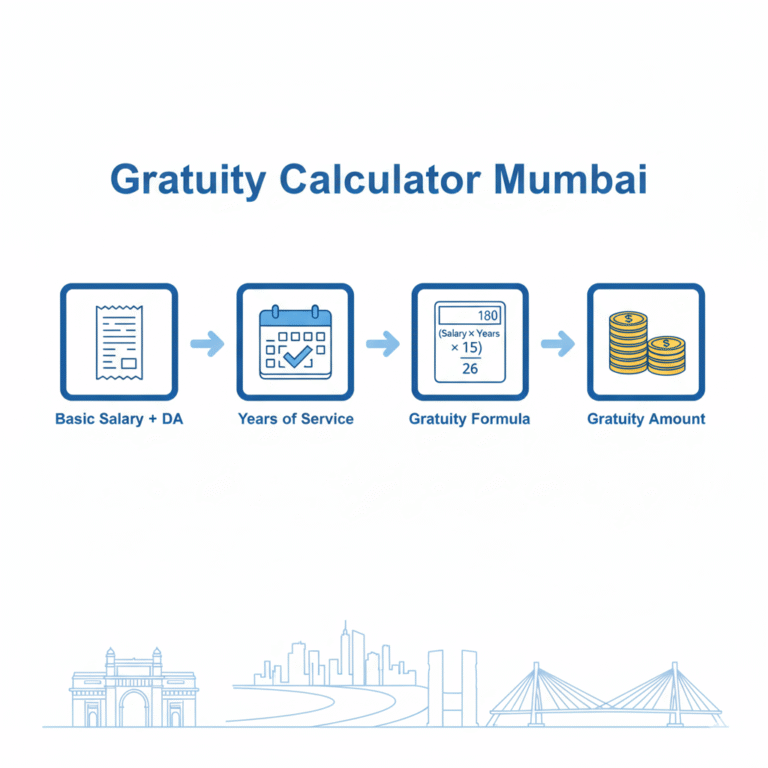

The standard formula for Gratuity Calculation in West Bengal

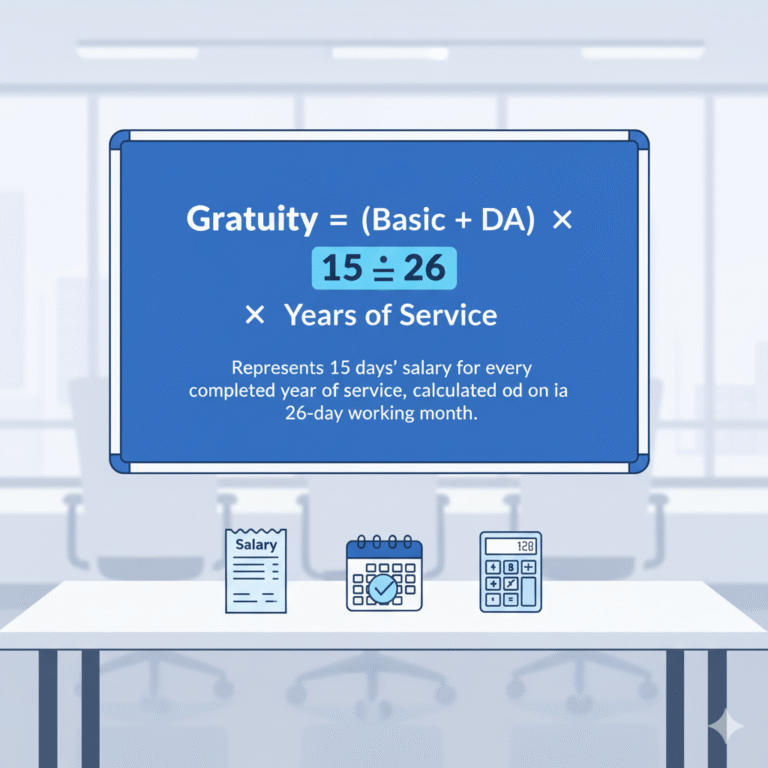

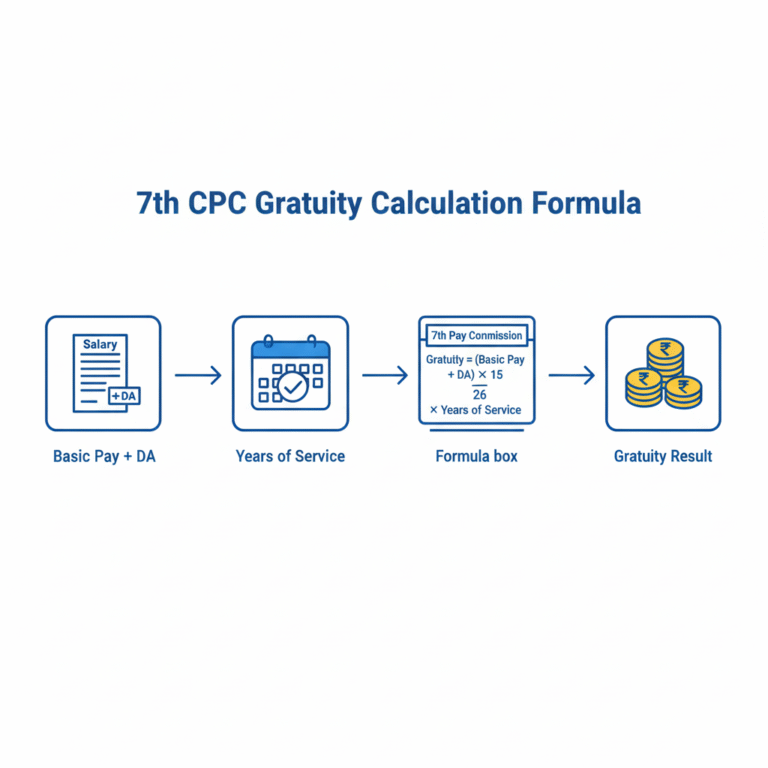

The central law defines gratuity as “fifteen days’ wages for every completed year of continuous service” or the amount calculated under any prescribed formula. In practice the commonly used formula is:

Gratuity = (Last drawn salary × 15 × Number of completed years of service) ÷ 26

Here, last drawn salary typically means basic pay + dearness allowance (DA). The divisor 26 is used because wages are normally taken on the basis of 26 working days in a month (15 days’ wages = 15/26 of a month’s salary). West Bengal government guidance and official state references use this formula when computing Gratuity Calculation in West Bengal under the Act. wb.gov.inChief Labour Commissioner

Notes on nuances:

- Some private calculators or employer schemes may use 30 as the divisor (treating month as 30 days) when an establishment’s internal payroll practice defines wages that way for non-covered establishments — always confirm which divisor applies in your specific case. Reputable government and state sources for West Bengal use the 26-day basis when interpreting the Act. wb.gov.in

- Only completed years of service are counted (for example 7 years and 11 months is counted as 7 years). Some courts have considered rounding rules in certain circumstances but the usual practice is to take only completed years unless the establishment’s policy is more generous. Chief Labour Commissioner+1

Step-by-step worked examples

Example 1 — Retirement after 12 completed years

- Last drawn basic + DA = ₹40,000 per month

- Completed years of service = 12

- Gratuity = (40,000 × 15 × 12) ÷ 26 = (40,000 × 180) ÷ 26 = 7,200,000 ÷ 26 ≈ ₹276,923

Example 2 — Resignation after 7 completed years

- Last drawn basic + DA = ₹25,000 per month

- Completed years = 7

- Gratuity = (25,000 × 15 × 7) ÷ 26 = (25,000 × 105) ÷ 26 = 2,625,000 ÷ 26 ≈ ₹100,962

Example 3 — Death in service after 3 years (special case)

- For death or permanent disability, the five-year rule is waived and gratuity becomes payable even if continuous service is less than five years. The calculation still uses the same formula (or as provided by the employer scheme) and is often subject to special higher multiples for death gratuity under some employer policies. Refer to the employer policy and the Act. Chief Labour Commissioner

These worked examples are illustrative — always confirm the employer’s definition of “last drawn salary” (basic + DA) and whether any additional contractual benefits (ex gratia) apply.

Ceiling on gratuity and tax treatment

The Payment of Gratuity Act empowers the Central Government to fix the maximum amount of gratuity payable under the Act. Important central updates:

- The central notification dated 29 March 2018 established a ceiling of ₹20 lakh as the maximum amount of gratuity payable under the Act (this replaced the earlier ₹10 lakh limit). This ceiling is what applies for most private-sector employees subject to the Act. Ministry of Labour & EmploymentDepartment of Public Enterprises

- Separate administrative notifications for certain categories of government employees have raised the ceiling for those groups in specific circumstances (for example some central pension/DA-linked notifications implemented different upper limits for certain central employees; check the exact departmental communication for applicability). DoppwThe Financial Express

Tax treatment: Gratuity received by an employee is eligible for exemption under the Income Tax Act up to prescribed limits. The tax-exempt portion follows the provisions and limits as per the Income Tax Act and the Payment of Gratuity Act — employees should consult a tax advisor about the tax treatment of amounts that exceed statutory ceilings or involve multiple employers. ClearTax

Gratuity Calculation in West Bengal specifics: application, time limits, and administrative steps

West Bengal’s implementing rules contain several practical procedures that matter to both employers and employees.

- Application period: Under the West Bengal Payment of Gratuity Rules, an employee who is eligible for gratuity is ordinarily required to make an application for payment within 120 days from the date on which the gratuity becomes payable (for example, from the date of retirement). If the employer does not pay within this period, the employee may apply to the controlling authority or labour commissioner for recovery. wblc.gov.in

- Gratuity register and records: Employers must maintain records and registers in accordance with the rules so that the computation and payment of gratuity can be audited and verified during inspections or disputes. wb.gov.inwblc.gov.in

- Form and procedure: The state rules prescribe forms and the office of the controlling authority or civil authorities where applications and disputes are to be lodged. Employers must provide the employee with details of calculation and any deductions, and should respond to applications within the statutory timeframes. wblc.gov.in

If an employer fails to pay, the employee can apply to the concerned authority named in the state rules and recover dues; the Rules and the central Act include provisions for recovery of gratuity as if it were an arrear of wages. Chief Labour Commissionerwblc.gov.in

Employer obligations and good payroll practice

Employers in West Bengal (and across India where the Act applies) must:

- Determine whether the establishment is covered and ensure compliance with the Act and state rules (maintain registers, post notices and forms, and implement correct payroll calculations). Chief Labour Commissionerwblc.gov.in

- Compute gratuity using the correct definition of last drawn salary (basic + DA) and the correct divisor for wages (26 days unless a different practice applies and is explicitly sanctioned in a workplace settlement). wb.gov.in

- Pay gratuity within the statutory timelines and respond to employee applications. If the employer contends that the employee is not eligible, the employer should document reasons clearly and seek recourse through the controlling authority rather than withholding payment arbitrarily. wblc.gov.inChief Labour Commissioner

Good payroll governance tip: Reconcile gratuity liabilities at least annually (include projected gratuity as part of long-term employee benefit provisioning) and document how partial years, breaks in service, and leaves are treated for continuity.

Handling special situations

Maternity leave and continuous service: The Payment of Gratuity (Amendment) provisions and subsequent notifications addressed counting of maternity leave in continuous service calculations. The central government has clarified and updated periods for counting maternity leave in continuous service calculations (for example, increasing the reference period to 26 weeks by notification). Employers should apply the notified period when calculating continuity for female employees. Press Information Bureau

Death and disablement: The Act specifically provides for gratuity to be paid in cases of death or permanent disability even if the employee has not completed five years of service. The calculation is carried out on the same wage basis and is usually paid to the nominee or legal heirs; in addition some employers have separate death gratuity policies that provide higher multiples. Chief Labour Commissioner

Seasonal establishments: For seasonal establishments, the Act provides a different rate (for example, seven days wages per season) — check the Act and the state rules for seasonal operations. Chief Labour Commissioner

Dispute resolution and recovery procedures Gratuity Calculation in West Bengal

If there is a disagreement over eligibility, calculation, or payment:

- The employee should first raise the matter in writing with the employer and request a time-bound response.

- If the employer fails to pay or respond, the employee can apply to the controlling authority designated under the West Bengal rules or approach the labour commissioner for recovery. Under the Act, unpaid gratuity can be recovered as an arrear of wages. wblc.gov.inChief Labour Commissioner

Contesting calculations: Where months or year counts are in dispute, documentary payroll evidence, attendance records and continuity proofs (service certificates, appointment/relieving letters) are the strongest proofs. Employers should maintain clear payroll ledgers and gratuity registers to avoid prolonged litigation.

Practical checklist for employees (narrative, not a list)

Employees should know their employer’s gratuity policy and confirm whether the establishment is covered by the Payment of Gratuity Act. Keep copies of appointment letters, salary slips showing basic and DA components, and service records showing joining and relieving/retirement dates. If you retire, resign after five years, or face permanent disablement or death in service, notify the employer and, if applicable, submit a formal gratuity application within the period laid down by the West Bengal rules (usually 120 days). If a problem arises, gather payroll evidence and approach the controlling authority as required.

Practical checklist for employers (narrative, not a list)

Employers need to review whether the Act applies to their establishment, keep accurate salary and attendance records, maintain the Gratuity Calculation in West Bengal register required under the West Bengal Rules, and train HR/payroll staff on correct computation and timelines. Establish and publish a clear internal policy about how partial years, maternity leave, and breaks in service are treated. If you rely on contracted workers, validate whether they are employees for the purposes of the Act — misclassification can lead to retrospective liabilities.

Common calculation pitfalls and how to avoid them

Many disputes arise from misunderstandings around the definition of “last drawn salary,” the divisor (26 vs 30), counting of completed years, and whether dearness allowance is included. Avoid these errors by using the statutory approach (basic + DA as last drawn salary; 15 days wages per completed year; divide by 26 for working-day wage basis unless an approved deviation applies) and documenting your method in the payroll policy. Keep records that can substantiate continuity in service and salary components. wb.gov.inChief Labour Commissioner

Online calculators and cross-checking estimates

Several reputed financial portals and payroll tools provide Gratuity Calculation in West Bengal to estimate your entitlement (for example ClearTax, ICICI, Groww). Such calculators are useful for quick checks but always cross-verify with payroll and the statutory formula. If there is any discrepancy between a calculator result and employer computation, rely on the Act, state rules and the employer’s payroll records for the final figure. ClearTaxICICI Direct

FAQ (declarative headings — no question marks)

Closing notes and next steps

For employees: Keep copies of salary slips, appointment and relieving letters, and a record of continuity. Request a formal Gratuity Calculation in West Bengal from payroll when you become eligible and cross-check using the statutory formula above.

For employers: Reconcile Gratuity Calculation in West Bengal liabilities annually, publish an internal gratuity policy aligned with the Act, maintain the gratuity register and forms required by West Bengal rules, and ensure timely payments and clear communication to avoid recoveries and penalties.

Authoritative references and further reading (selected official sources):

- Payment of Gratuity Act, 1972 — consolidated/official text. India CodeChief Labour Commissioner

- Chief Labour Commissioner (Central) guidance and Act summary. Chief Labour Commissioner

- West Bengal Payment of Gratuity Rules, 1973 — West Bengal Labour Department (official state rules PDF). wblc.gov.inkarmamgmt.com

- West Bengal government guidance on gratuity calculation and registers. wb.gov.in

- Central notifications increasing gratuity ceiling (notification dated 29 March 2018 and later administrative communications). Ministry of Labour & EmploymentDepartment of Public Enterprises